Geography: This article is applicable for ANZ Transactive - Global customers banking in all ANZ geographies.

Full details are available in Features by Geography.

Full details are available in Features by Geography.

Documentary Collections Overview

ANZ Transactive Trade allows you to view and manage your Import and Export Collections portfolio online. You can view Collection Schedules, Collection Acknowledgements and manage your Finance and Settlement Instructions within the application based on your user entitlements. You can also create and maintain reference data, view, and download reports; customise company-specific reports; and initiate, view and respond to mail messages.

A Notification will be sent in ANZ Transactive advising you that an Import or Export Collection has been process at the bank.

What is a Documentary Collection?

A documentary collection is a trade transaction in which the exporter hands over to the bank the task of collecting payment for goods. The bank sends the shipping documents to the importer's bank together with payment instructions.

Relevant export documents, together with an appropriate bill of exchange (or other financial instruments), are forwarded by the exporter’s bank in accordance with the exporter's instructions to the importer’s bank for presentation to the importer.

The export documents are released to the importer against payment (known as documents against payment) or acceptance of the bill of exchange (known as documents against acceptance) and payment is made to the exporter on receipt of proceeds.

Relevant export documents, together with an appropriate bill of exchange (or other financial instruments), are forwarded by the exporter’s bank in accordance with the exporter's instructions to the importer’s bank for presentation to the importer.

The export documents are released to the importer against payment (known as documents against payment) or acceptance of the bill of exchange (known as documents against acceptance) and payment is made to the exporter on receipt of proceeds.

Documentary Collection transaction types

Transaction types that can be associated with Documentary Collection instrument are as follows:

| TRANSACTION TYPE | DESCRIPTION |

| Adjustment | Collection or refund of fees, charges or other miscellaneous amounts. |

| Change | A change to a Document Collection instrument instruction. |

| Collect | An Inward Collection instruction outlining the terms and conditions set out in the documentary collection. |

| Collection Acceptance | An Acceptance indicates documents presented for a Documentary Collection with Payment Terms = Available by Negotiation, and the documents are accepted. This transaction will generate a ‘Time Instrument’ prefix reference of ‘TI’ (Import) and 'TO' (Export) and used with subsequent communications about the acceptance. |

| Create Usance | Associated to the Acceptance processing, this transaction will generate a ‘Time Instrument’ prefix reference of ‘TI’ (Import) and 'TO' (Export) and used with subsequent communications about the acceptance. |

| Issue | An Export Collection instruction outlining the terms and conditions set out in the documentary collection. |

| Liquidate Usance | Payment for the Acceptance. |

| Payment | Documentary Collection payment or closure. |

| Request Refinance | Request finance for an Export Collection. |

| Settlement Instruction Response | Provide Payment instructions for a Documentary Collection or Acceptance. |

Context Panel menu

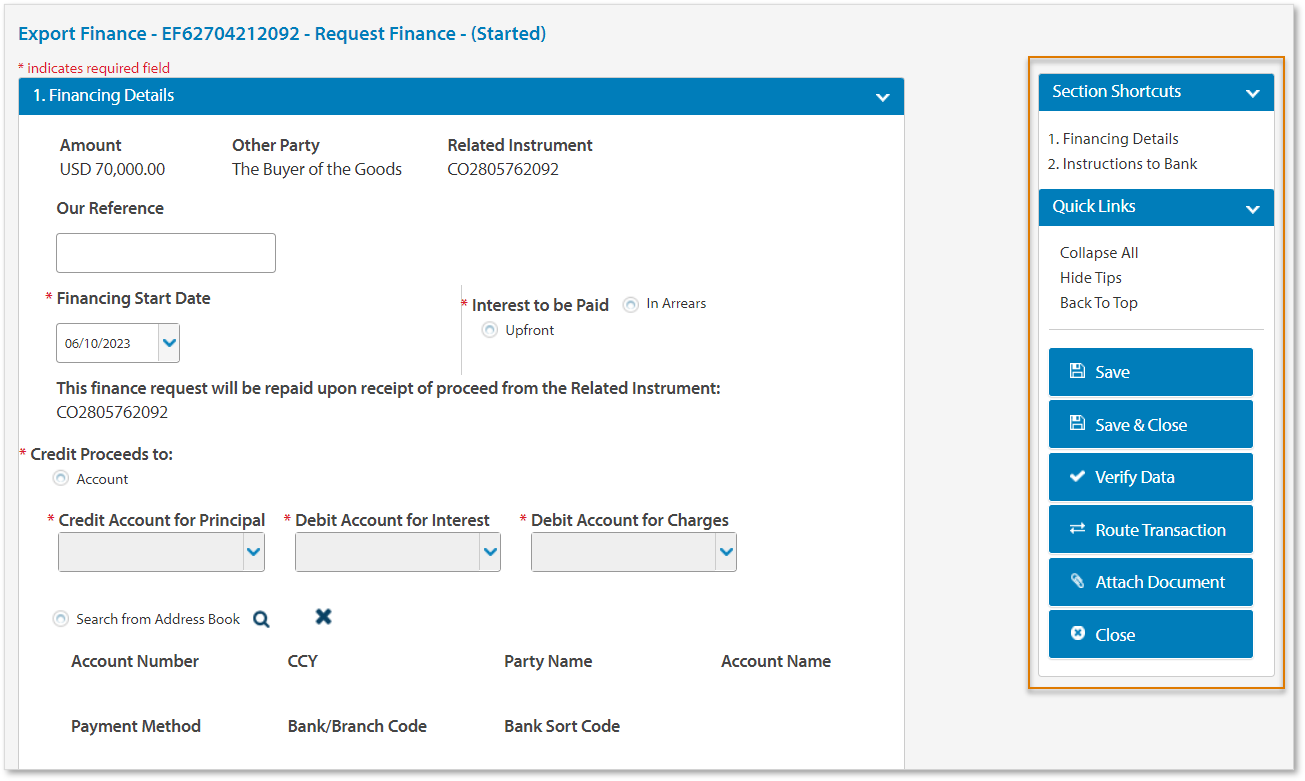

Context Panel menu presented on the right of the transaction screen will be visible to the user based on the Transaction Type, Workflow Status and the User's Entitlements. See the example below:

The Context Panel buttons displayed will depend on the Documentary Collection transaction screen you are accessing, the workflow status and your user entitlements.

| BUTTON | DESCRIPTION |

| Attach Document | Click to attach supporting documents to the transaction in DOCX, PDF and XLSX. |

| Authorise | Click to Authorise the transaction.

Transactions may require multiple Authorisation based on your Organisation's signing mandate.

|

| Authorise and Delete | Click Authorise and Delete to authorise the transaction and delete the message from Mail Messages. |

| Close | Click to close out of the transaction. |

| Edit | Click to edit the details of a transaction before the transaction is authorised. |

| Print Finance Request | Click to print the finance request instructions tradeform. |

| Print Settlement Instruction Details | Click to print the settlement instructions tradeform. |

| Reply to Bank | Respond to the bank with further instructions on how to manage the transaction and/or attach supporting documentation. |

| Route Transaction | Click to route transaction to another user in the Organisation or Subsidiary company. |

| Save | Click to save entered data in transactions periodically. |

| Save & Close | Click to save entered data and close out of the transaction. |

| Send for Repair | Click to send the transaction in a Ready to Check, Ready to Authorise or Partially Authorised status to the user(s) in your Organisation to Repair and update the required details. |

| Verify Data | Click to verify the data in the transaction details fields. The system will return any errors or warnings for missing or inconsistent information. The transaction will progress to a Ready to Authorise stage when successful. |

| View Terms As Entered | Click to view the data as entered upon creating and authorising the transaction, with a Processed by Bank status. |

Request Export Financing - Export Collection

The standard workflow process to create a request for export finance for an Export Documentary Collection is as follows:

Request Export Financing screen

The Export Financing screen provides the mandatory and additional input fields required to submit a finance request.

1. Financing Details

| FIELD NAMES | IMAGE |

Finance Details

|

2. Instructions to Bank

| FIELD NAMES | IMAGE |

Additional Instructions to Bank

|

Request Export Financing

There are multiple ways to create a request for Export Financing for an Export Documentary Collection. Please choose from one of the following methods:

-

Method 1:

- Click Transactions from the Application Banner menu, then Request Export Financing

- Search and select the Export Collection from the Instrument to be Financed window

- Choose the Instrument Type (Export Collection) and click Select.

-

Method 2:

- Open a previous Export Collection instrument, then click Request Financing

1. Financing Details

This finance request will be repaid upon receipt of proceed from the Related Instrument.

| STEP | ACTION |

| 1 | If required, enter Our Reference |

| 2 | Enter Financing Start Date |

| 3 | Choose Interest to be Paid

|

| 4 | Choose Credit Proceeds to:

|

2. Instructions to Bank

| STEP | ACTION |

| 1 | If required, enter any Additional Instructions for Bank. Please choose from one of the following methods:

|

Attach Documents to an Export Finance

Eligible users can attach supporting documentation to the transaction, such as the format and text to be issued. The documents are sent to ANZ electronically in DOCX, PDF and XLSX, from within the transaction screen.

The maximum document file size cannot exceed 5mb per file, with a maximum of 20 files per transaction. The File Name must be less than 30 characters.

To attach documents, follow the below steps:

| STEP | ACTION |

| 1 | Click Attach Documents from the Context Panel menu |

| 2 | Please choose from one of the following methods:

RESULT: The attached documents appear as an icon before being uploaded.

|

| 3 | If required, update the File Name. The File Name must be less than 30 characters. |

| 4 |

Enter the Category for the file:

|

| 5 | Click Upload Files

RESULT: The documents appear in Attachment(s).

You can view the attached document(s) by selecting the document name. Alternatively, you can delete the attached document(s) by selecting the document checkbox and clicking Delete Documents from the Context Panel menu.

|

Verify an Export Finance

Click Verify Data from the Context Panel menu to validate data input and attached supporting documents. The system will verify that all mandatory fields marked with an asterisk are complete.

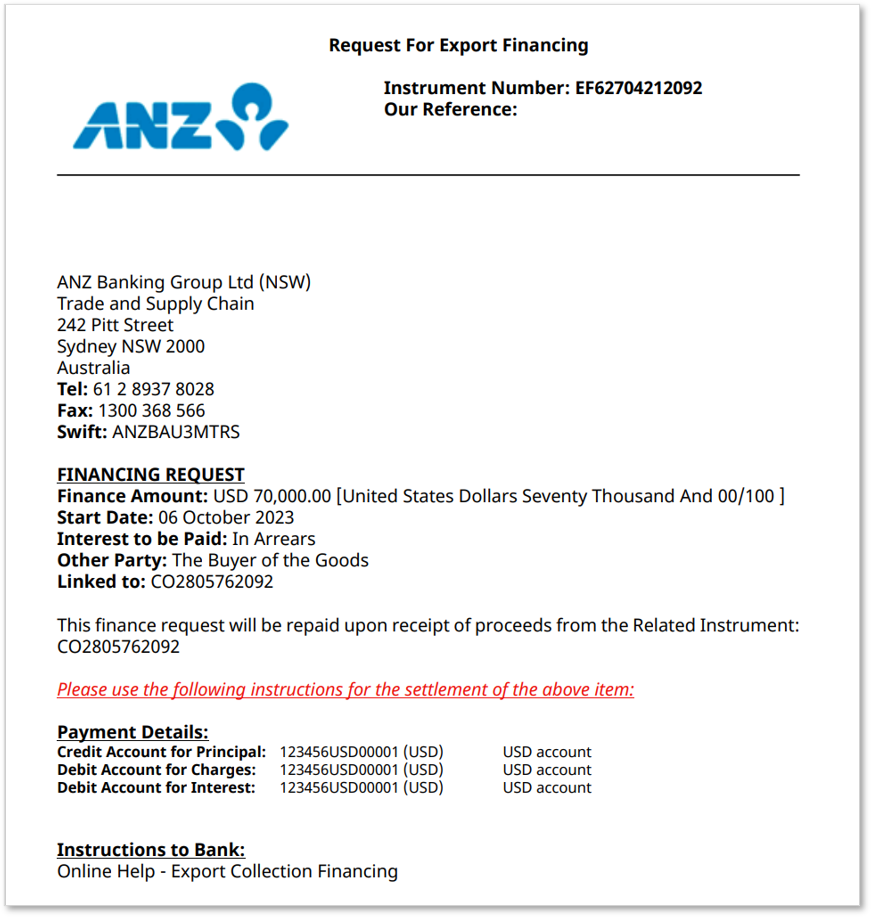

If required, click Print Finance Request from the Context Panel

View sample Finance Request tradeform

| MESSAGE TYPE | DESCRIPTION |

| Successful | The data is successfully verified, and the Workflow Status is updated to Ready to Authorise.

RESULT: <Instrument Number> successfully updated. Saved at <Time>.

|

| Error |

The data is unsuccessful, and field(s) need attention. Click on the error message hyperlink to take you to the impacted field.

The Workflow Status will remain in Started.

RESULT: Example: Part Payment Instructions is required.

Update the impacted field(s), then click Verify again.

|

Authorise an Export Finance

Click Authorise from the Context Panel menu to approve transactions in a Ready to Authorise or Partially Authorised status from within the transaction screen. You can also Authorise a transaction from the Pending Transactions screen.

Follow the instructions below that apply to you:

Authorise via One Time Password (OTP)

| STEP | ACTION |

| 1 | Press and hold down the < arrow and lock icon on your VASCO security device |

| 2 | Enter your 6-digit PIN |

| 3 | Press 1 on your device to display the authorisation code |

| 4 | Enter your authorisation code, then click Approve

RESULT: A confirmation message confirms the transaction(s) is approved.

|

Authorise via Signature Code (SIG)

| STEP | ACTION |

| 1 | Press and hold down the < arrow and lock icon on your VASCO security device |

| 2 | Enter your 6-digit PIN |

| 3 | Press 2 on your device and enter the token code from your screen |

| 4 | Press the < arrow to display the authorisation code |

| 5 | Enter your authorisation code, then click Approve

RESULT: A confirmation message confirms the transaction(s) is approved.

|

Authorise via a Push Notification

| STEP | ACTION |

| 1 | Tap on the ANZ Digital Key notification on your mobile device to launch the ANZ Digital Key app |

| 2 | Tap Log On and authenticate access by entering your PIN, Face ID or Fingerprint ID. The screen will display the details of the request requiring approvals |

| 3 | Review the pending request details shown in ANZ Digital Key and tap to Accept or Decline the request |

| 4 | The request will be processed and completed. Close the app as no further action is required |

Authorise via a QR Code

| STEP | ACTION |

| 1 | Tap Log On in ANZ Digital Key and authenticate access by entering your PIN, Face ID or Fingerprint ID |

| 2 |

Tap Scan QR Code on the screen.

ANZ Digital Key will switch to camera mode. Use the camera to scan the request approval QR Code from your desktop or laptop computer. |

| 3 | Review the pending request details shown in ANZ Digital Key and tap to Accept or Decline the request |

| 4 | The request will be processed and completed. Close the app as no further action is required. |

Create Settlement Instructions - Import Collection

A Settlement Instruction allows you to submit payment instructions of your Import Collection.

Import Collection Settlement Instruction screen

The Settlement Instruction screen provides the mandatory and additional input fields required to submit an Import Collection settlement instruction.

| FIELD NAMES | IMAGE |

Loan Summary

|

|

Settlement Instructions

|

|

Payment Details

|

|

|

Additional Instructions

|

|

Foreign Exchange Rate Details

|

|

Other FX Instructions

|

Issue an Import Collection Settlement Instruction

For more information, please refer to How to create an instrument.

| STEP | ACTION |

| 1 | Click Transactions from the Application Banner menu, then Create Settlement Instruction |

| 2 | Search and select the Import Collection to submit a Settlement Instruction |

| 3 | If required, enter your Reference. This reference will appear on your reporting and account statements. |

| 4 | Enter the Settlement Instructions

Please choose from the following instructions for settlement:

|

| 5 | If required, enter the Finance Terms

Please choose from the following methods:

|

| 6 | Enter the payment date |

| 7 | Enter the Payment Details

Please choose from the following methods:

|

| 8 | If required, enter other Additional Instructions for your Settlement Request |

| 9 | If required, enter your Foreign Exchange Rate Details

Please choose from the following methods:

|

Attach Documents to a Settlement Instruction

Eligible users can attach supporting documentation to the transaction. The documents are sent to ANZ electronically in DOCX, PDF and XLSX, from within the transaction screen.

The maximum document file size cannot exceed 5mb per file, with a maximum of 20 files per transaction. The File Name must be less than 30 characters.

To attach documents, follow the below steps:

| STEP | ACTION |

| 1 | Click Attach Documents from the Context Panel menu |

| 2 | Please choose from one of the following methods:

RESULT: The attached documents appear as an icon before being uploaded.

|

| 3 | If required, update the File Name. The File Name must be less than 30 characters. |

| 4 | Enter the Category for the file:

|

| 5 | Click Upload Files

RESULT: The documents appear in Attachment(s).

You can view the attached document(s) by selecting the document name. Alternatively, you can delete the attached document(s) by selecting the document checkbox and clicking Delete Documents from the Context Panel menu.

|

Verify a Settlement Instruction

Click Verify Data from the Context Panel menu to validate data input and attached supporting documents. The system will verify that all mandatory fields marked with an asterisk are complete.

| MESSAGE TYPE | DESCRIPTION |

| Successful | The data is successfully verified, and the Workflow Status is updated to Ready to Authorise.

RESULT: <Instrument Number> successfully updated. Saved at <Time>.

|

| Error |

The data is unsuccessful, and field(s) need attention. Click on the error message hyperlink to take you to the impacted field.

The Workflow Status will remain in Started.

RESULT: Example: Currency of account is different than instrument currency. Provide Foreign Exchange Rate Details.

Update the impacted field(s), then click Verify again.

|

| Warning | The data is successful but provides a warning to alert you to a particular field(s). If required, update the field and re-Verify.

The Workflow Status is updated to Ready to Authorise. |

Authorise a Settlement Instruction

Click Authorise from the Context Panel menu to approve transactions in a Ready to Authorise or Partially Authorised status from within the transaction screen. You can also Authorise a transaction from the Pending Transactions screen.

Follow the instructions below that apply to you:

Authorise via One Time Password (OTP)

| STEP | ACTION |

| 1 | Press and hold down the < arrow and lock icon on your VASCO security device |

| 2 | Enter your 6-digit PIN |

| 3 | Press 1 on your device to display the authorisation code |

| 4 | Enter your authorisation code, then click Approve

RESULT: A confirmation message confirms the transaction(s) is approved.

|

Authorise via Signature Code (SIG)

| STEP | ACTION |

| 1 | Press and hold down the < arrow and lock icon on your VASCO security device |

| 2 | Enter your 6-digit PIN |

| 3 | Press 2 on your device and enter the token code from your screen |

| 4 | Press the < arrow to display the authorisation code |

| 5 | Enter your authorisation code, then click Approve

RESULT: A confirmation message confirms the transaction(s) is approved.

|

Authorise via a Push Notification

| STEP | ACTION |

| 1 | Tap on the ANZ Digital Key notification on your mobile device to launch the ANZ Digital Key app |

| 2 | Tap Log On and authenticate access by entering your PIN, Face ID or Fingerprint ID. The screen will display the details of the request requiring approvals |

| 3 | Review the pending request details shown in ANZ Digital Key and tap to Accept or Decline the request |

| 4 | The request will be processed and completed. Close the app as no further action is required |

Authorise via a QR Code

| STEP | ACTION |

| 1 | Tap Log On in ANZ Digital Key and authenticate access by entering your PIN, Face ID or Fingerprint ID |

| 2 |

Tap Scan QR Code on the screen.

ANZ Digital Key will switch to camera mode. Use the camera to scan the request approval QR Code from your desktop or laptop computer. |

| 3 | Review the pending request details shown in ANZ Digital Key and tap to Accept or Decline the request |

| 4 | The request will be processed and completed. Close the app as no further action is required. |

Manage an Export Collection

View the transactions, advices and acknowledgements associated with an Export Collection:

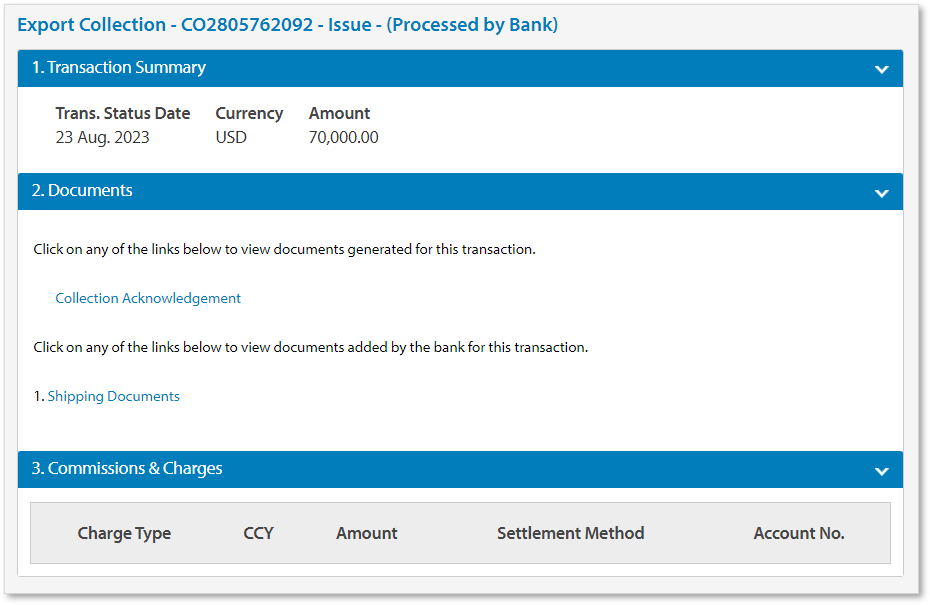

View an Export Collection - Issue

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Export Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Export Collection Issue screen provides a summary of the Export Collection submitted by this customer to ANZ for processing and onforwarding to another bank and includes the Collection Acknowledgement and any documents added by ANZ.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| Collection Acknowledgement | Collection Acknowledgement issued to the exporter by ANZ.

View sample Collection Acknowledgement

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

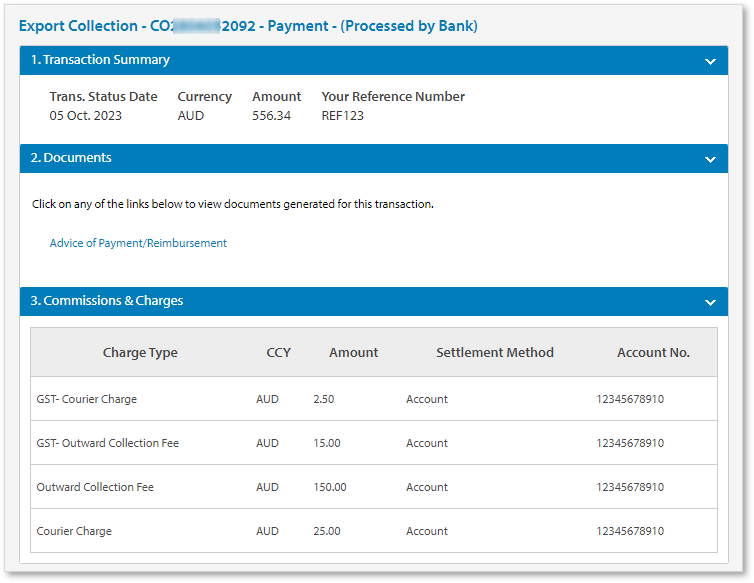

View an Export Collection - Payment

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Export Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Export Collection Payment screen provides a summary of the Export Collection payment details submitted and processed by ANZ and includes the Advice of Payment/Reimbursement.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| Your Reference Number | Your reference. |

| 2. DOCUMENTS | |

| Advise of Payment/Reimbursement | Advise of Payment/Reimbursement issued to the importer by ANZ.

View sample Advise of Payment/Reimbursement

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type, e.g., Courier charge, Collection Fees. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

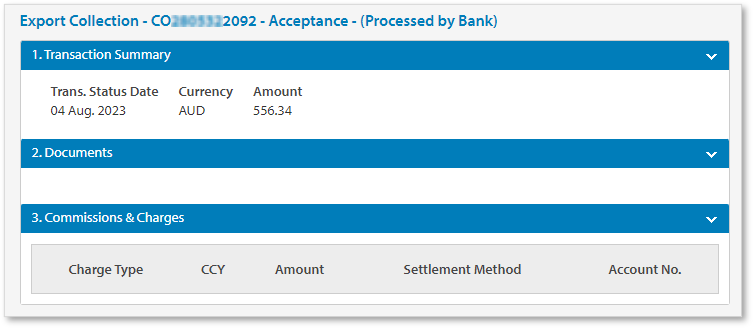

View an Export Collection - Acceptance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Export Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Export Collection Acceptance screen provides a summary of the Export Collection term instrument details submitted and processed by ANZ.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| NIL | NIL |

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

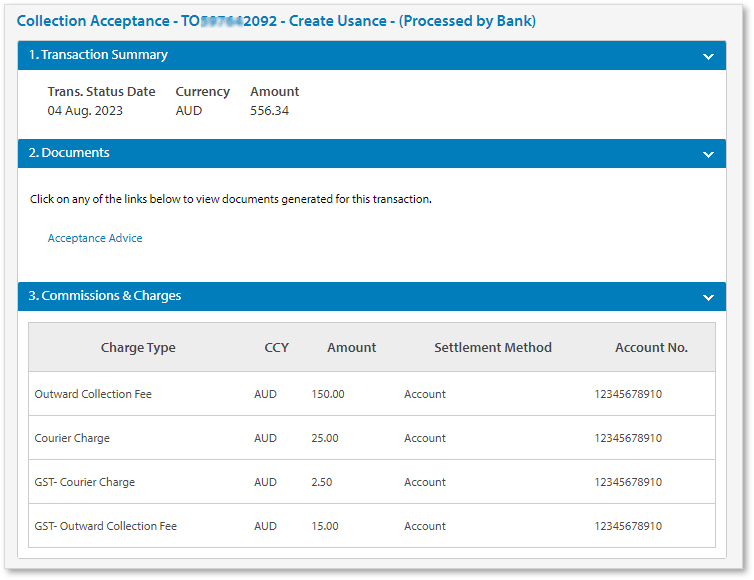

View an Export Collection - Create Usance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Export Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Export Collection Create Usance screen provides a summary of the Export Collection usance terms submitted and processed by ANZ and includes the Acceptance Advice.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| Acceptance Advice | Acceptance Advise issued to the importer by ANZ.

View sample Acceptance Advise

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type, e.g., Courier Charge, Collection Fees. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

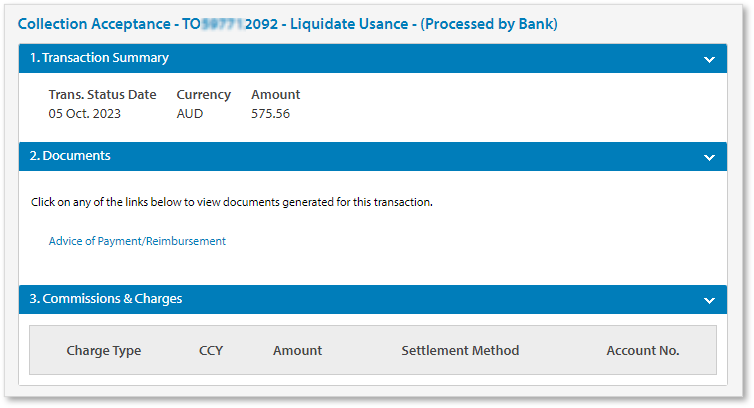

View an Export Collection - Liquidate Usance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Export Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Export Collection Liquidate Usance screen provides a summary of the Export Collection payment terms submitted and processed by ANZ and includes the Advice of Payment/Reimbursement.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| Advice of Payment/Reimbursement | Advice of Payment/Reimbursement issued to the importer by ANZ.

View sample Advice of Payment/Reimbursement

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type, e.g., Courier Charge, Collection Fees. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

Manage an Import Collection

View the transactions, advices and acknowledgements associated with an Import Collection:

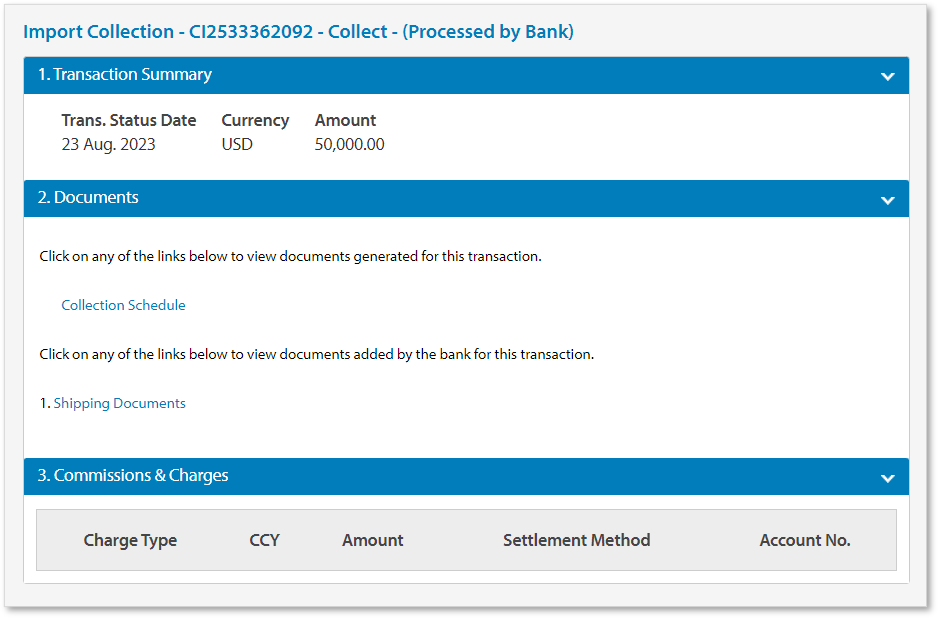

View an Import Collection - Collect

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Import Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Import Collection Collect screen provides a summary of the Import Collection submitted by the Importer's bank and processed by ANZ and includes the Collection Schedule and any documents added by ANZ.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| Collection Schedule | Collection Schedule issued to the importer by ANZ.

View sample Collection Schedule

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

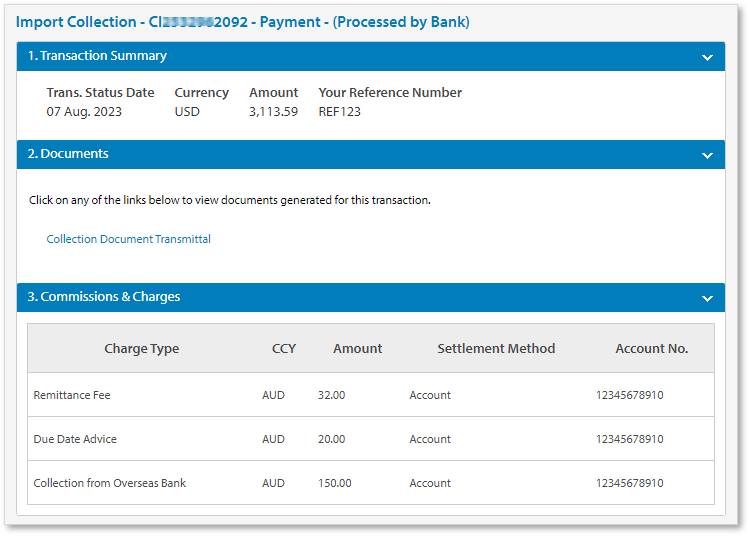

View an Import Collection - Payment

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Import Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Import Collection Payment screen provides a summary of the Import Collection payment submitted, and processed by ANZ and includes the Collection Document Transmittal.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| Your Reference Number | Your Reference. |

| 2. DOCUMENTS | |

| Collection Document Transmittal | Collection Document Transmittal issued to the importer by ANZ.

View sample Collection Document Transmittal

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type, e.g., Remittance Fee, Due Date Advice |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

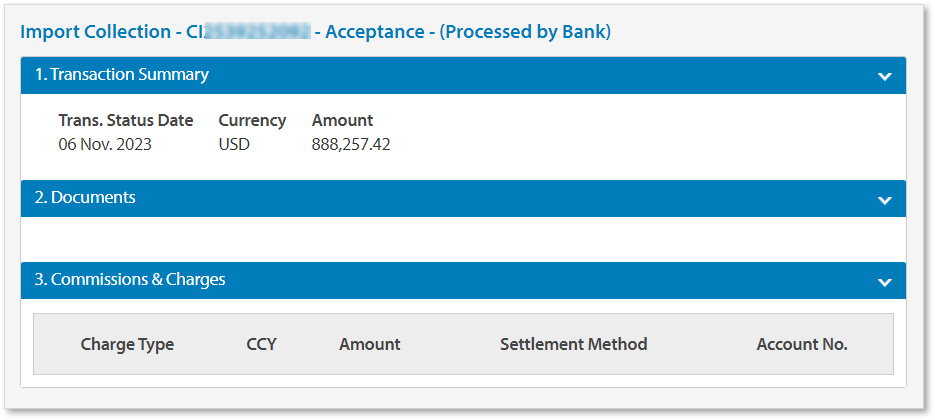

View an Import Collection - Acceptance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Import Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu |

The Import Collection Acceptance screen provides a summary of the Import Collection received.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| NIL | NIL |

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

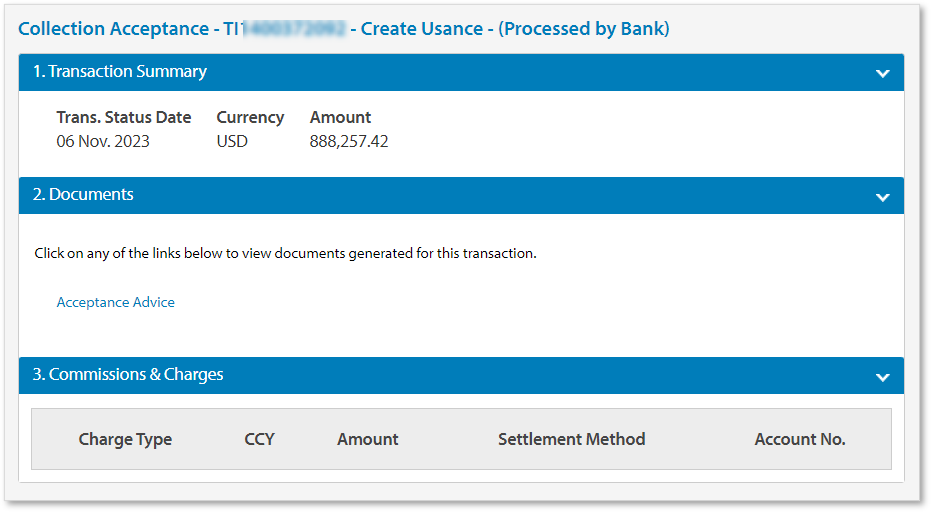

View an Import Collection - Create Usance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Import Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu. |

The Import Collection Acceptance screen provides a summary of the Import Collection acceptance processed by ANZ and includes the Acceptance Advice.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| Acceptance Advice | Acceptance Advice issued to the exporter.

View sample Acceptance Advice

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type. |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

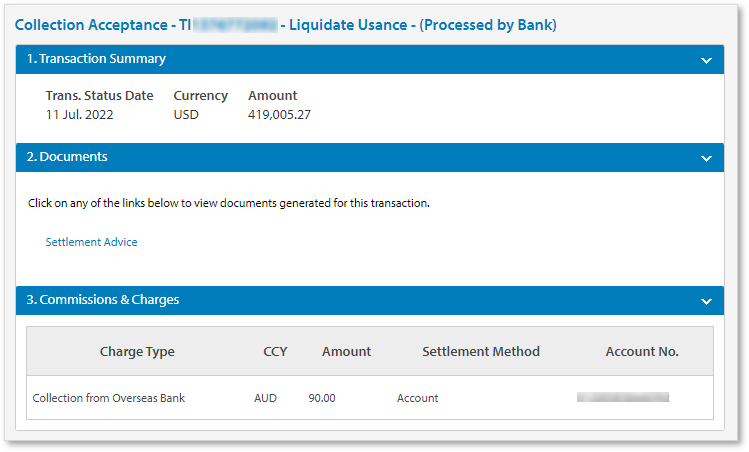

View an Import Collection - Liquidate Usance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP | ACTION |

| 1 |

There are multiple ways to view an Import Collection transaction. Please choose from one of the following methods:

|

| 2 | Click Close from the Context Panel menu. |

The Import Collection Liquidate Usance screen provides a summary of the Import Collection payment processed by ANZ and includes the Settlement Advice.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY | |

| Trans. Status Date | Transaction status date. |

| Currency | Currency of the Instrument. |

| Amount | Amount of the Instrument. |

| 2. DOCUMENTS | |

| Settlement Advice | Settlement Advice issued to the importer.

View sample Settlement Advice

|

| 3. COMMISSIONS & CHARGES | |

| Charge Type | Instrument charge type, e.g., Collection from Overseas Bank |

| CCY | Currency of the charge type. |

| Amount | Amount of the charge type. |

| Settlement Method | Settlement Method of the charge type. |

| Account No. | Account number where the charge type is debited. |

Documentary Collection Reports

Documentary Collection reports list issued, received, and outstanding Import and Export Collections within a date range. You can also download transaction lists from the Pending Approval, Current Instruments and Past Instruments screens in ANZ Transactive - Global.

For a complete list of Trade reports, please refer to Transactive Trade - Reports.

For a complete list of Trade reports, please refer to Transactive Trade - Reports.

Documentary Collection reports in ANZ Transactive Trade

In ANZ Transactive Trade, Documentary Collection reports provide a list of issued, received, and outstanding Import and Export Collections within a date range. You can download these reports in CSV, PDF and XLSX.

REPORTS

| REPORT NAME | DESCRIPTION |

| Export Collections - Current | Outstanding Export Collections. See sample report in Documentary Collection FAQs. |

| Export Collections - Historical | Export Collections transactions within a date range. See sample report in Documentary Collection FAQs. |

| Import Collections - Current | Outstanding Import Collections. See sample report in Documentary Collection FAQs. |

| Import Collections - Historical | Import Collections transactions within a date range. See sample report in Documentary Collection FAQs. |

VIEW AND DOWNLOAD

To view and download Export Letter of Credit reports in ANZ Transactive Trade, follow the below steps:

| STEP | ACTION |

| 1 | Click Reports > Standard Reports from the Application Banner menu |

| 2 | Filter to Show Trade |

| 3 | Click a Report Name from the grid |

| 4 | If required, enter Report Criteria, e.g., Date Range |

| 5 | Click Show Report

RESULT: The report is visible on the screen.

|

| 6 | If required, click Expand to view the report in the same size as your screen. |

| 7 | If required, click Save As to save a copy of the report, then enter a Report Name, Report Description, Report Type and save as a Standard or Custom Report. Then click Save. |

| 8 | If required, click the icon to download the report in CSV, PDF or XLSX |

| 9 | Click Close to exit out of the report |

Documentary Collection reports in ANZ Transactive - Global

In ANZ Transactive - Global, Documentary Collection reports provide a list of all transactions in the Pending Approval, Current Instruments and Past Instruments screens. You can also schedule, download and email the transaction in CSV or PDF.

For more information, please refer to ANZ Transactive - Global Trade Finance Reports.

Documentary Collection FAQs

I need help with completing my trade instrument online. Who can I contact?

Please contact your ANZ Trade Representative for assistance.

What does a Current Export Collection report look like?

What does a Historical Export Collection report look like?

What does a Current Import Collection report look like?

What does a Historical Import Collection report look like?