Geography: This article is applicable for ANZ Transactive - Global customers banking in Australia and New Zealand.

Full details are available in Features by Geography.

Full details are available in Features by Geography.

How are user permissions applied for Periodic Direct Debits?

User permissions for Periodic Direct Debits align with their Direct Debit Template entitlements. For example, if a user has ‘View Only’ access to Direct Debit templates, they will also have ‘View Only’ access to Periodic Direct Debits.

When does a Periodic Direct Debit need to be approved?

- If your organisation has Approval Required for Templates selected from Administration > Other Settings > Division Details Screen, then the Periodic Direct Debit schedule requires approval

- If the active Periodic Direct Debit is edited and your organisation has Approval Required for Templates selected from Administration > Other Settings > Division Details Screen, then the Periodic Direct Debit schedule requires approval

- For each scheduled instance when the Periodic Direct Debit is due, the Periodic Direct Debit instance requires approval from the Current Direct Debits screen or Pending Approval workspace widget

Why can I approve a direct debit created from a periodic direct debit schedule when I do not have 'Allow Self Approval' entitlements?

The system automatically generates the periodic direct debit instance up to seven days before the value date. Therefore, the ‘Allow Self Approval’ entitlements do not apply.

What types of Periodic Direct Debit reports are available?

Periodic Direct Debit Audit Report - From the Periodic Direct Debit screen, select a periodic direct debit from the list. From the View Periodic Direct Debit screen, click Reports > Periodic Direct Debit Audit Report to generate a .csv report

When is a direct debit instance created?

A direct debit is created from the schedule seven days before the Value Date unless there are less days between the Start Date and Next Run Date.

How does the Periodic Direct Debit schedule handle non-business days?

Australian-based accounts

If the Next Run Date is a non-business day, the direct debit Value Date will either be the previous or next business day, based on the schedule. Below are some examples for how non-business days are handled:

| Start Day | Repeat On | Non-Business Days | Next Run Date | Direct Debit Created On | Direct Debit Value Date |

|---|---|---|---|---|---|

| 19 June | Day 26 | Process on previous business day | 26 June (Sat) | 19 June | 25 June |

| 19 June | Day 26 | Process on next business day | 26 June (Sat) | 19 June | 28 June |

| 19 June | Day 25 | Either choice is not looked at as Next run Date is a business day | 25 June (Fri) | 18 June | 25 June |

| 19 June | Day 19 | Process on next business day | 19 June (Sat) | 19 June | 21 June |

New Zealand-based accounts

If the Next Run Date is a non-business day the Direct Debit will be processed on that day.

If the Next Run Date is a non-business day the Direct Debit will be processed on that day.

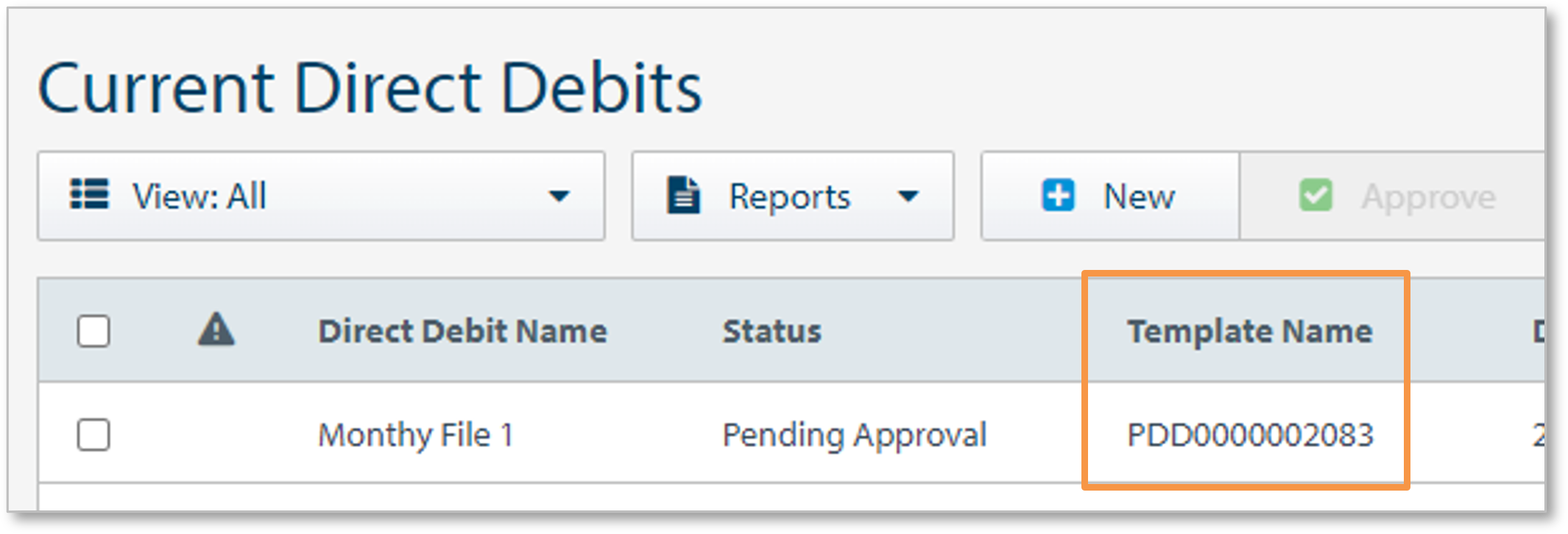

How can I tell which direct debits are periodic direct debits?

The Template Name for periodic direct debits starts with “PDD”:

Can I receive a notification when the Periodic Direct Debit is awaiting approval?

Yes. You can enable 'Transactions Pending Authorisation' from your Alerts and Notifications settings.

Can I stop a Periodic Direct Debit schedule?

Yes. To stop the Periodic Direct Debit schedule from generating any more direct debit instances, you can Delete the Periodic Direct Debit. The schedule will appear in the Periodic Direct Debit screen with a deleted status.