View the transactions, advices and acknowledgements associated with an Export Letter of Credit:

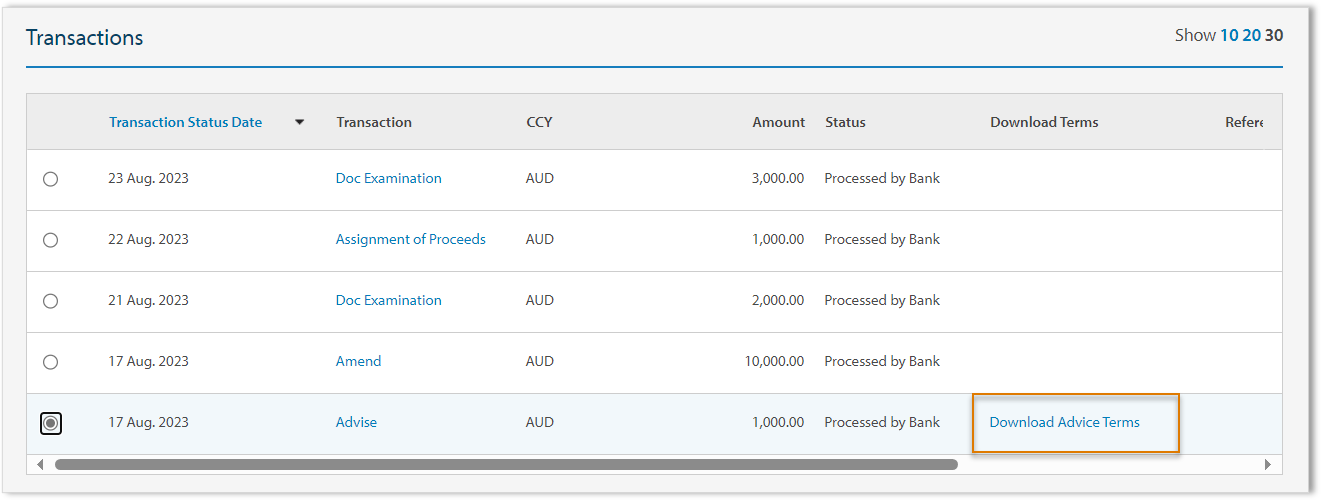

Download Advice Terms

Eligible users can view and download advice terms within the instrument's Current Terms Summary.

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on an Instrument ID from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on an Instrument ID from the grid

|

| 2 |

Click Download Advice Terms from the Advise transaction in the Current Terms Summary screen to download the SWIFT700/701, MT710/711, MT720/721 in either SWIFT TXT or XML format. Please contact your Trade Representative about setting your preferred option.

View sample Download Terms

|

Create Confirmation Request

Eligible users can create an Export LC Confirmation Request within Mail Messages for an existing letter of credit.

| STEP |

ACTION |

| 1 |

There are multiple ways to create a Confirmation Request. Please choose from one of the following methods:

-

Method 1: Click the Mail Messages envelope from the Application Banner, then click New

-

Method 2: Search and select an Export Letter of Credit instrument, then click Create Message

|

| 2 |

Choose Export LC: Confirmation Request from the Select Mail Message Type window, then click Select

|

| 3 |

Enter the Subject title |

| 4 |

Search, select or enter the Instrument ID for requesting Confirmation under the Export Letter of Credit |

| 5 |

Enter the Confirmation commencement date and your reference in the Message |

| 6 |

If required, Attach Documents

|

| 7 |

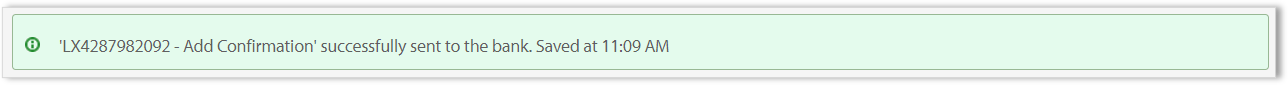

Click Send to Bank

RESULT: Confirmation request has been sent to the bank for review and processing.

|

Create Document Pre-check

- This service is being provided per the EXPORT DC PRE-CHECK AUTHORITY.

If you have not completed an Authority with ANZ, please contact us for assistance.

- For all other Mail Messages, please refer to Mail Messages and Notifications.

Eligible users can create an Export LC Document Pre-check within Mail Messages for an existing letter of credit.

| STEP |

ACTION |

| 1 |

There are multiple ways to create a Document Pre-check request. Please choose from one of the following methods:

-

Method 1: Click the Mail Messages envelope from the Application Banner, then click New

-

Method 2: Search and select an Export Letter of Credit instrument, then click Create Message

|

| 2 |

Choose Export LC: Document Pre-check from the Select Mail Message Type window, then click Select

|

| 3 |

Enter the Subject title |

| 4 |

Search, select or enter the Instrument ID to request pre-checks of the attached documentation under the Export Letter of Credit |

| 5 |

Enter any additional information in the Message field |

| 6 |

Click Attach Documents to attach all the documents (including shipping documents) required for a pre-check |

| 7 |

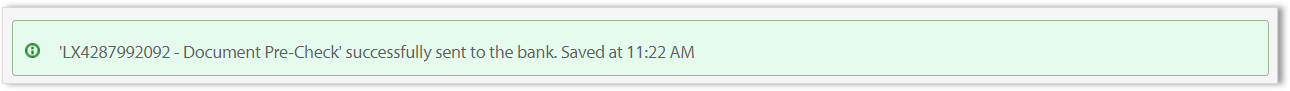

Click Send to Bank

RESULT: Pre-check request has been sent to the bank for document checking.

|

View an Export Letter of Credit - Advise transaction

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu

|

The Export Letter of Credit Advise screen provides a summary of the Export LC submitted by the Importer's bank and processed by the bank and includes the Cover Letter.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| 2. DOCUMENTS |

| Cover Letter to Ben or Nab |

Cover letter issued to the exporter by the bank and includes the contents of the SWIFT700 message (where available), disclaimers and a field for Authorised Signature(s).

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type. |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type. |

| Account No. |

Account number where the charge type is debited. |

| 4. TERMS SUMMARY |

| Instrument Amount |

Instrument currency and amount, including any amendments, but excludes any tolerances. |

| Available Amount |

Available currency and amount, including any payments, amendments, adjustments and tolerances. |

| Equivalent Amount |

Equivalent base currency and amount. |

| About % |

Amount tolerance. |

| Issue Date |

Instrument issue date. |

| Expiry Date |

Instrument expiry date. |

| Latest Shipment Date |

Latest shipment date. |

| Confirmed |

Confirmation of Export Letter of Credit i.e., Yes / No. |

| Payment Terms |

Payment terms if the instrument, e.g., Sight. |

| Reference Number |

Beneficiary's Reference Number. |

| Applicant Details |

Applicant's name and address. |

| Beneficiary Details |

Beneficiary's name and address. |

View an Export Letter of Credit - Amendment

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Amendment screen provides a summary of the Export LC received and includes the Amendment Cover Letter outlining the amended details in a copy of the SWIFT 707 message.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| 2. DOCUMENTS |

| Amendment Cover Letter |

Amendment cover letter issued to the exporter by the bank and includes the contents of the SWIFT707 message (where available) and any fees or charges.

View sample Amendment Cover Letter

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type. |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type. |

| Account No. |

Account number where the charge type is debited. |

| 4. TERMS SUMMARY |

| Instrument Amount |

Instrument currency and amount, including any amendments, but excludes any tolerances. |

| Available Amount |

Available currency and amount, including any payments, amendments, adjustments and tolerances. |

| Equivalent Amount |

Equivalent base currency and amount. |

| About % |

Amount tolerance. |

| Issue Date |

Instrument issue date. |

| Expiry Date |

Instrument expiry date. |

| Latest Shipment Date |

Latest shipment date. |

| Confirmed |

Confirmation of Export Letter of Credit i.e., Yes / No. |

| Payment Terms |

Payment terms if the instrument, e.g., Sight. |

| Reference Number |

Beneficiary's Reference Number. |

| Applicant Details |

Applicant's name and address. |

| Beneficiary Details |

Beneficiary's name and address. |

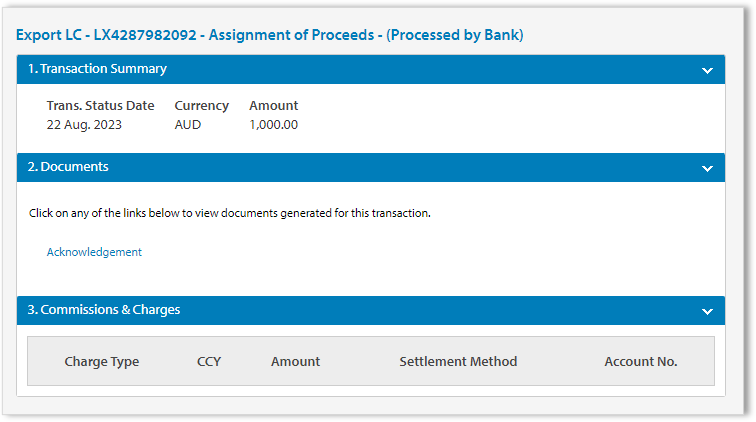

View an Export Letter of Credit - Assignment of Proceeds

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click View Terms as Entered to view the data as entered upon creating and authorising the transaction. |

| 3 |

Click Close from the Context Panel menu. |

The Export Letter of Credit Assignment of Proceeds screen provides a summary of the Export LC assignment processed by the bank.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| 2. DOCUMENTS |

| Acknowledgement |

Acknowledgement issued to the exporter includes a cover letter and a correspondence to the assignee.

View sample Acknowledgement

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type. |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type. |

| Account No. |

Account number where the charge type is debited. |

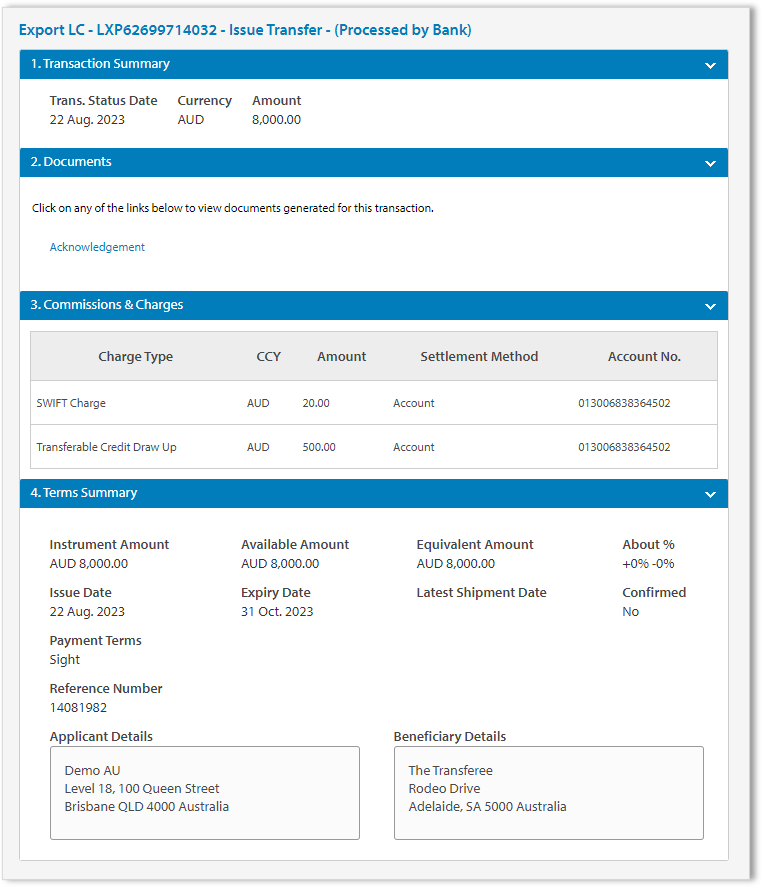

View an Export Letter of Credit - Transfer

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click View Terms as Entered to view the data as entered upon creating and authorising the transaction. |

| 3 |

Click Close from the Context Panel menu. |

The Export Letter of Credit Transfer screen provides a summary of the Export LC transfer processed by the bank.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Transfer amount of the Instrument. |

| 2. DOCUMENTS |

| Acknowledgement |

Acknowledgement issued to the exporter includes a cover letter, any fees and a copy of the SWIFT720 message.

View sample Acknowledgement

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type, e.g., SWIFT Charge, Transferable Credit Draw Up |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type, e.g., Account |

| Account No. |

Account number where the charge type is debited. |

| 4. Terms Summary |

| Instrument Amount |

Instrument currency and amount, including any amendments, but excludes any tolerances. |

| Available Amount |

Available currency and amount, including any payments, amendments, adjustments and tolerances. |

| Equivalent Amount |

Equivalent base currency and amount. |

| About % |

Amount tolerance. |

| Issue Date |

Instrument issue date. |

| Expiry Date |

Instrument expiry date. |

| Latest Shipment Date |

Latest shipment date. |

| Confirmed |

Confirmation of Export Letter of Credit Transfer i.e., Yes / No. |

| Payment Terms |

Payment terms if the instrument, e.g., Sight. |

| Reference Number |

Second Beneficiary's Reference Number. |

| Applicant Details |

Applicant's name and address. |

| Beneficiary Details |

Second Beneficiary's name and address. |

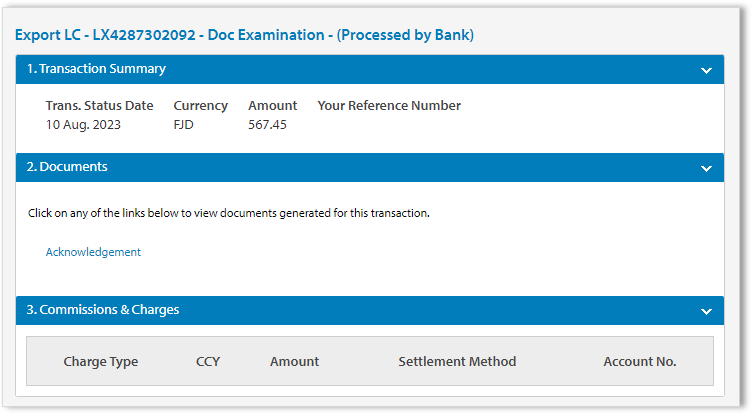

View an Export Letter of Credit - Doc Examination

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Doc Examination screen provides a summary of the Export LC submitted by the Importer's bank and processed by the bank and includes the Acknowledgement and Discrepancy Advice (if any).

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| Your Reference |

Your reference. |

| 2. DOCUMENTS |

| Acknowledgement |

Acknowledgement issued to the exporter includes a summary of the Export LC.

View sample Acknowledgement

|

| Discrepancy Advice (if any) |

Discrepancy Advice issued to the exporter includes discrepancies and any fees or charges.

View sample Discrepancy Advice

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type. |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type. |

| Account No. |

Account number where the charge type is debited. |

View an Export Letter of Credit - Discrepancy Notice

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view and reply to a discrepancy notice, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Discrepancy Notice screen provides the discrepancy details for the documents presented under the Export LC and includes the Discrepancy Advice.

Below are the fields associated with the screen:

| DISCREPANCY NOTICE |

| Subject |

Discrepancy Notice: <Instrument Number - x> Export Documentary LC. |

| Related to Instrument ID |

Instrument Number. |

| Presentation Amount |

Documents presentation amount. |

| Other Party |

Applicant name. |

| Presentation Number |

Sequential document presentation number. |

| Presentation Date |

Date documents presented. |

| Related Documents |

Discrepancy Advice.

View sample Discrepancy Advice

|

| Message |

Additional information. |

| Discrepancy(ies) |

List of identified discrepancies from the presented documents. |

| PO/Invoice Discrepancy(ies) |

List of identified discrepancies from the presented Purchase Order or Invoices. |

| Discrepancy Response Status |

Current status of the discrepancy response e.g., Not Yet Started, Started, Authorised |

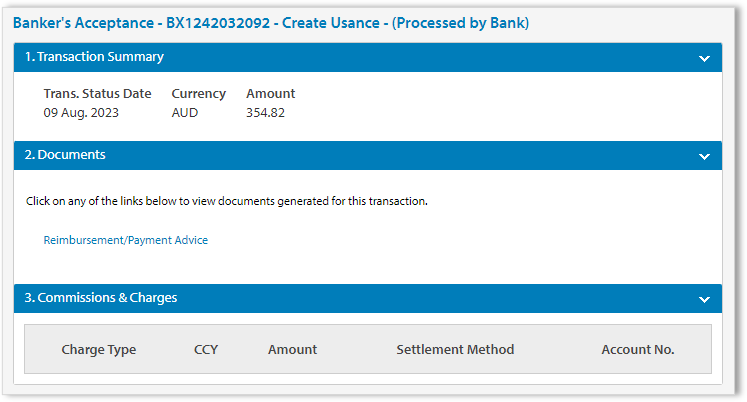

View an Export Letter of Credit - Create Usance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Create Usance screen provides a summary of the Export LC's Banker's Acceptance processed by the bank and includes the Reimbursement/Payment Advice.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| 2. DOCUMENTS |

| Reimbursement/Payment Advice |

Reimbursement/Payment Advice issued to the exporter includes summary of the banker's acceptance and any fees or charges.

View sample Reimbursement/Payment Advice

|

| Discrepancy Advice (if any) |

Discrepancy Advice issued to the exporter includes discrepancies and any fees or charges.

View sample Discrepancy Advice

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type, e.g., Courier Fee, Negotiation Fee |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type, e.g., Account |

| Account No. |

Account number where the charge type is debited. |

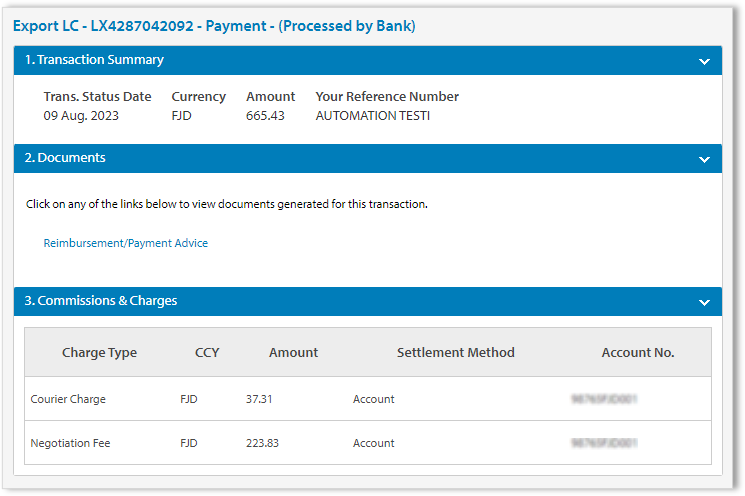

View an Export Letter of Credit - Payment

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Payment screen provides a summary of the Export LC payment initiated by the Importer's bank and processed by the bank and includes the Reimbursement/Payment Advice.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| Your Reference |

Your reference. |

| 2. DOCUMENTS |

| Reimbursement/Payment Advice |

Reimbursement/Payment Advice issued to the exporter includes summary of the payment and any fees or charges.

View sample Reimbursement/Payment Advice

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type, e.g., Courier Fee, Negotiation Fee |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type, e.g., Account |

| Account No. |

Account number where the charge type is debited. |

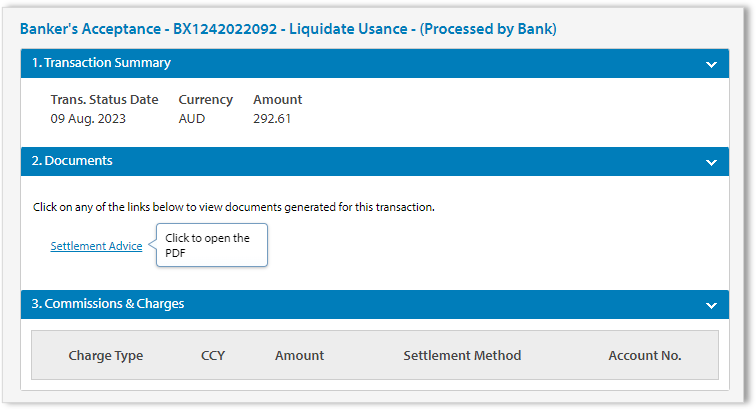

View an Export Letter of Credit - Liquidate Usance

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Liquidate Usance screen provides a summary of the Export LC processed by the bank.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| Your Reference |

Your reference. |

| 2. DOCUMENTS |

| Settlement Advice |

Settlement Advice issued to the exporter includes liquidation details for presented documents and any fees or charges. Settlement Advice may also include refinance details.

View sample Settlement Advice

|

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type. |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type. |

| Account No. |

Account number where the charge type is debited. |

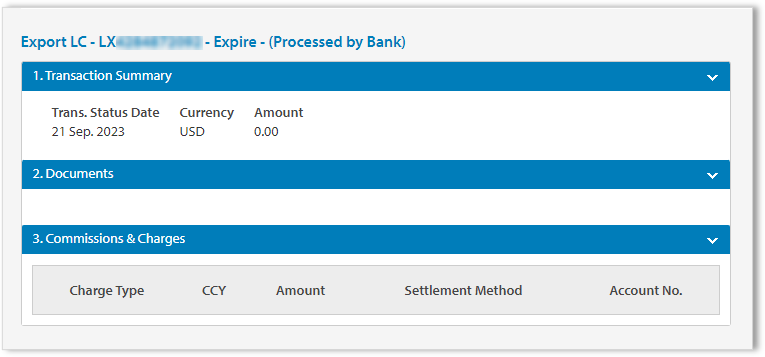

View an Export Letter of Credit - Expire activity

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Expire screen provides a summary of the expired Export LC processed by the bank.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| 2. DOCUMENTS |

| NIL |

NIL |

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type. |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type. |

| Account No. |

Account number where the charge type is debited. |

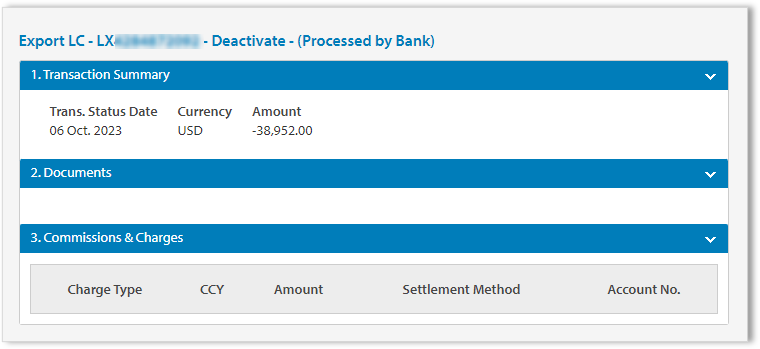

View an Export Letter of Credit - Deactivation activity

Eligible users can view transaction details provided within the instrument. You can also view transaction details via Trade Reports. For more information, please refer to

Reports in ANZ Transactive Trade. To view a transaction, follow the below steps:

| STEP |

ACTION |

| 1 |

There are multiple ways to view an Export LC transaction. Please choose from one of the following methods:

-

Method 1: From your Home screen dashboard, search and click on a transaction from the grid

-

Method 2: Click Notifications from the Application Banner, then search and click on a transaction from the grid

-

Method 3: Click Transactions > History from the Application Banner menu, then search and click + to expand the Instrument, and click on an instrument type

|

| 2 |

Click Close from the Context Panel menu |

The Export Letter of Credit Deactivation screen provides a summary of the deactivated Export LC processed by the bank.

Below are the fields associated with the screen:

| 1. TRANSACTION SUMMARY |

| Trans. Status Date |

Transaction start date. |

| Currency |

Currency of the Instrument. |

| Amount |

Amount of the Instrument. |

| 2. DOCUMENTS |

| NIL |

NIL |

| 3. COMMISSIONS & CHARGES |

| Charge Type |

Instrument charge type. |

| CCY |

Currency of the charge type. |

| Amount |

Amount of the charge type. |

| Settlement Method |

Settlement Method of the charge type. |

| Account No. |

Account number where the charge type is debited. |