Geography: This article is applicable for ANZ Transactive - Global customers banking in Pacific Islands and Laos.

Full details are available in Features by Geography.

Full details are available in Features by Geography.

About International Payment Templates (Asia & Pacific)

What is an International Payment Template?

An international payment template allows you to setup frequently used payment instructions to transfer funds from a single funding account to one or more nominated beneficiary accounts worldwide using an ANZ-supported and tradeable currency. International payments, also known as cross-border payments or telegraphic transfers, often involve two currencies where a foreign currency exchange rate is required.Once successfully created, you can use the preconfigured template to create your payment instructions.

For more information, please refer to Asia & Pacific Payment Types.

For more information, please refer to Asia & Pacific Payment Types.

Payment Template Rules for International Payments

- Non-fixed payment templates: When creating a payment from a template, some fields cannot be edited, including the division, bank/branch, debit account and payment method.

- Fixed payment templates: When creating a payment from a fixed template, additional fields will be restricted if 'Allow Modifications' checkbox has not been selected, including the amount, details of payment and invoice details.

- Individual Debits indicator will be enabled for selection when two or more beneficiaries have been added to the payment template.

- Confidential indicator will be enabled for selection for users with Confidential Payments entitlements.

- Payment instructions within a template are not considered mandatory, as additional information can be added at time of payment, including payment amount, additional information, etc.

Who can create an international payment template

- Eligible users with Initiator and account access can create and manage a domestic payment template based on your organisation's predetermined user permissions and payment settings. These role permissions can include:

- Initiator

- Initiate/Authorise

- Full Access

- Only users who are entitled to Confidential Payments will be able to view, edit and approve payments created from a template when the confidential indicator selected.

Payment template input screens

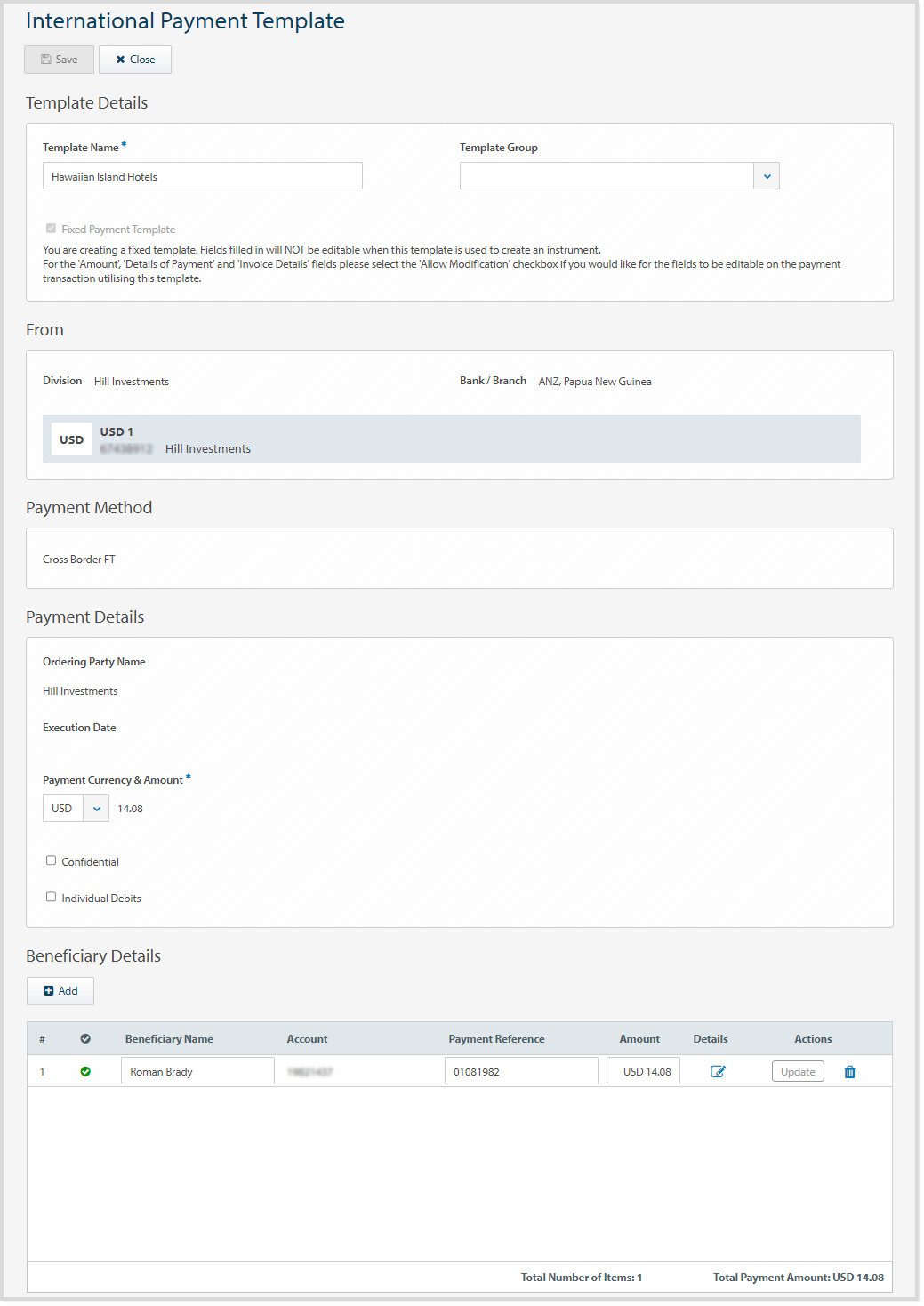

International Payment Template screen

The following is an example of an international payment template screen with fields including the template name and template group. All other fields replicate the International Payment screen.

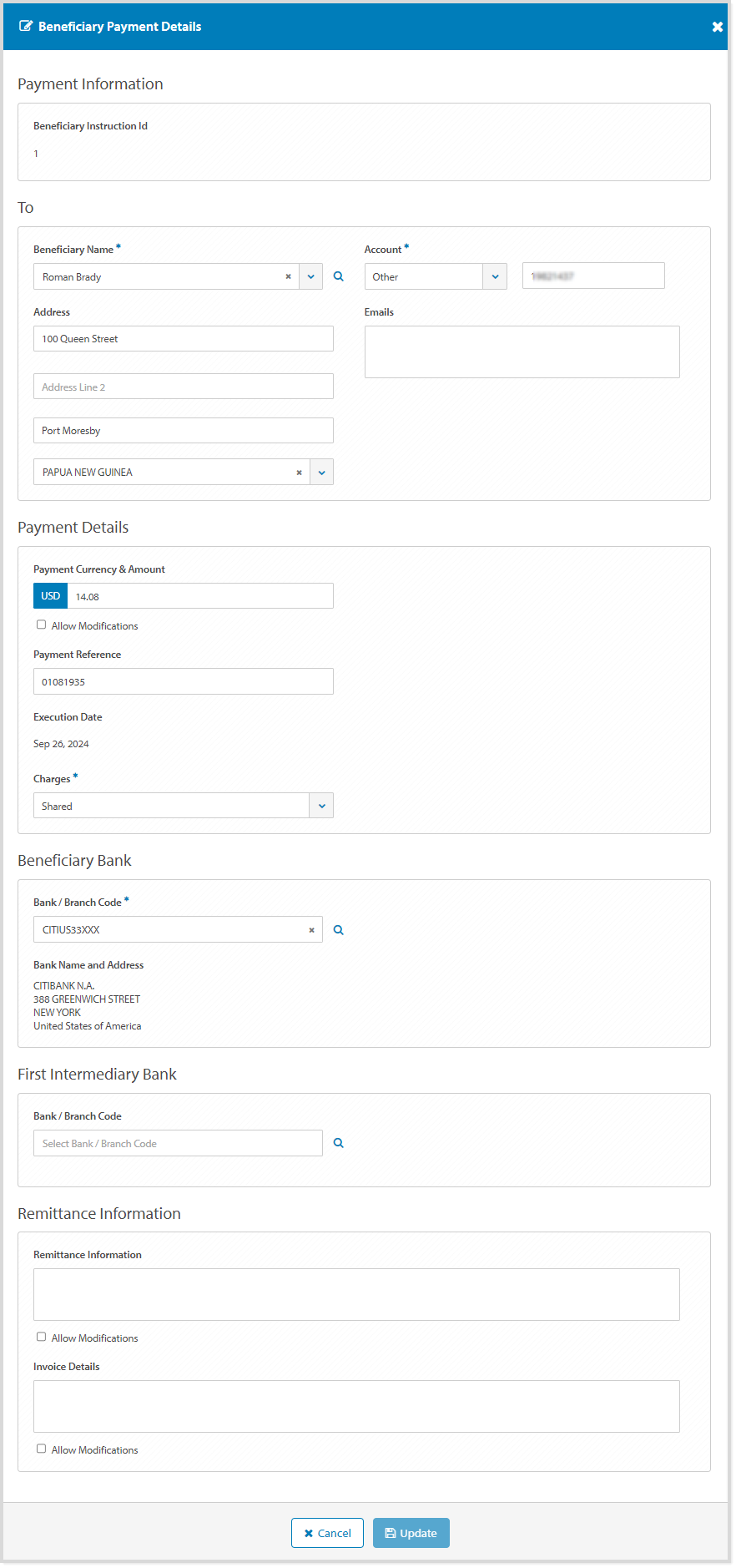

Beneficiary Payment Details screen

The following image is an example of a Beneficiary Payment Details screen with fields including the beneficiary's name, address and account details, beneficiary bank details, payment reference, remittance and invoice details.

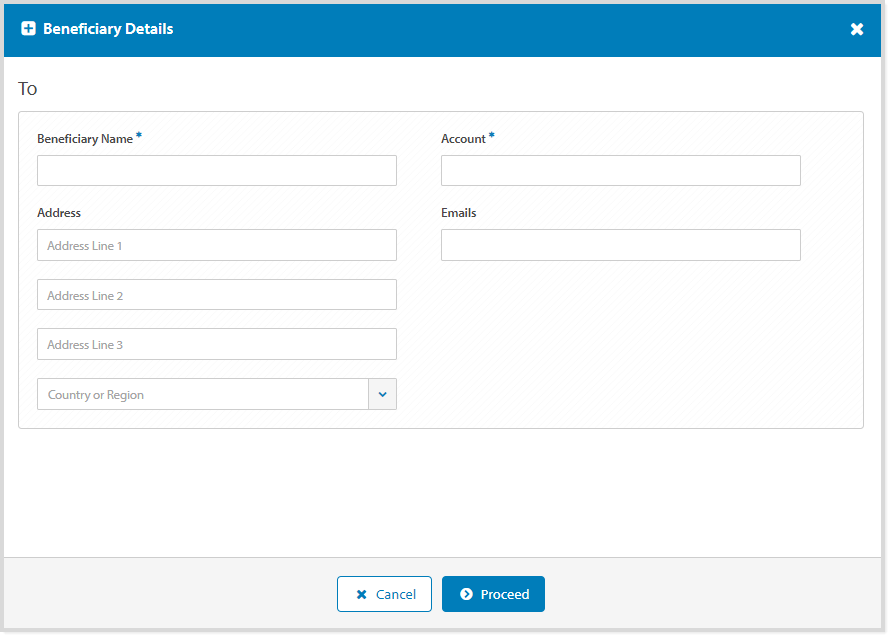

Beneficiary Details screen

The following image is an example of the Beneficiary Details screen with fields including the beneficiary's name, address, account and beneficiary email address.

Create a payment template

To create an Asia & Pacific international payment template, follow the steps below:

| STEP | ACTION | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Click Asia & Pacific Payments > Templates menu. | ||||||||||||||||||||||||||||

| 2 | Click New on the Control Bar. | ||||||||||||||||||||||||||||

| 3 | Click International Payment Template. | ||||||||||||||||||||||||||||

| 4 | Enter a Template Name up to 70 characters. This will become the Template Name when you create a payment from the template. | ||||||||||||||||||||||||||||

| 5 | Select Template Group. | ||||||||||||||||||||||||||||

| 6 | If required, tick the Fixed Payment Template checkbox to restrict fields from being edited when creating the payment. | ||||||||||||||||||||||||||||

| 7 | If required, select the Division the payment will be made from. If you are entitled to more than one division, you can set a default division for future payments. The Bank/Branch field will prepopulate from the Division selected. |

||||||||||||||||||||||||||||

| 8 | Select the Debit Account. | ||||||||||||||||||||||||||||

| 9 | If required, select the Payment Currency, if different from the debit account currency. The net Payment Amount will be populated when the Beneficiary amount(s) are entered. |

||||||||||||||||||||||||||||

| 10 | If required, select Confidential to restrict access to view, edit and approve the payment created from the template. | ||||||||||||||||||||||||||||

| 11 | If required, select Individual Debits to display a separate debit entry for every credit on your account statement report. | ||||||||||||||||||||||||||||

| 12 | Click Add to add one or more beneficiary details using the following options:

Add Beneficiary from your Beneficiaries list

Search and select the Beneficiary from the Beneficiary Name field, then proceed to next steps. If required, click Add again to add additional beneficiaries.

Add New Beneficiary

Users must have entitlements to create new beneficiaries to complete these steps.

Currently, new beneficiaries cannot be saved to your Beneficiaries menu.

|

||||||||||||||||||||||||||||

| 13 | If required, enter a Payment Reference up to 20 characters. | ||||||||||||||||||||||||||||

| 14 | Enter the Beneficiary payment Amount. | ||||||||||||||||||||||||||||

| 15 | If required, click Details icon to view and update additional beneficiary information. Fields available:

Add or update Beneficiary Payment Details

|

||||||||||||||||||||||||||||

| 16 | If required, repeat above steps to add each beneficiary to the template. | ||||||||||||||||||||||||||||

| 17 | Click Save. | ||||||||||||||||||||||||||||

| 18 | Click Close to return to the Create Payment Template screen. | ||||||||||||||||||||||||||||

| 19 | Click Close to return to the Templates screen. |

Next Steps

When the template has been successfully saved, the next steps can be: