Geography: This article is applicable for ANZ Transactive – Global customers banking in Philippines

Full details are available in Features by Geography.

Full details are available in Features by Geography.

GSRT PHP to USD template functionality will be available in the coming months.

About GSRT Templates

What is a GSRT template?

Gross Settlement Real Time (GSRT) template allows you to setup frequently used payment instructions to transfer funds using the Philippine Domestic Dollar Transfer System (PDDTS) to transfer funds from your Philippine domiciled USD account registered to ANZ Transactive – Global, to a beneficiary's Philippines domiciled USD account in the Philippines. Payments are processed same day, rather than overnight.Once successfully created, you can use the preconfigured template to create your payment instructions.

Payment Method Rules for GSRT Payments

- Disable Beneficiary changes prevent users from adding or editing any beneficiaries when a payment is created from a template. If your organisation has enabled this product setting in Division Settings, then this indicator cannot be removed.

- Fields marked with an asterisk (*) within a template are considered mandatory. Additional information can be added at time of payment, including value date, additional information, etc.

- Individual Debit indicator will not be displayed for Domestic Salary Payments as this will automatically be disabled by default.

- Template Approvals are required if your organisation needs Approval for templates when creating, editing or deleting a template. Once approved, the template can be used to create a payment.

- New Beneficiaries added to a template may need to be approved before the template can be used to create a payment.

- Invalid Character rules apply to this payment type.

Who can create a GSRT template?

- Eligible users with Payment Management role permissions and account access can create and manage a GSRT payment based on your organisation's predetermined user permissions and payment settings. These role permissions can include:

- Manage Payments - Adhoc (Adhoc & Approved Beneficiaries)

- Manage Payments - Approved Beneficiary / Templates

- Manage Payments - Import Payments

Who can create and action a Domestic Salary payment Template?

- The Domestic Salary payment option is only available to view and action if you have the following entitlements:

- Payroll - view full payment instructions

- Mask Confidential - view limited payment instructions when approving the payment.

- Fields within a salary payment will be masked, including beneficiary name, beneficiary bank, account number, reference and payment amount. These fields will be represented by 'XXXX' and only visible to users with applicable entitlements.

For more information, please refer to Role Permissions and User Permissions.

Payment template input screens

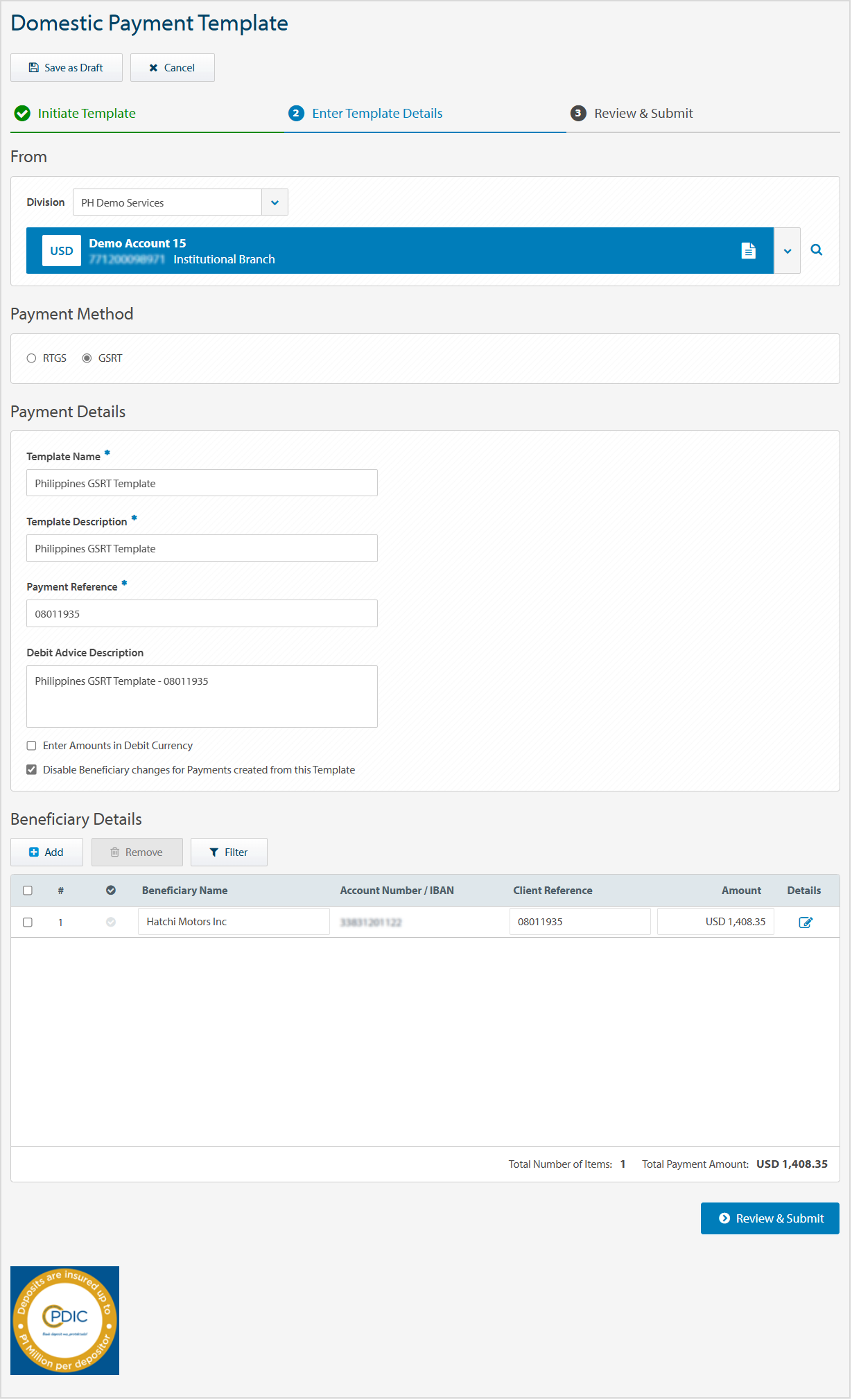

Domestic Payment template screen

The following image is an example of a domestic payment screen with fields including the division, debit account, payment method, payment name and reference, debit advice description and beneficiary details.

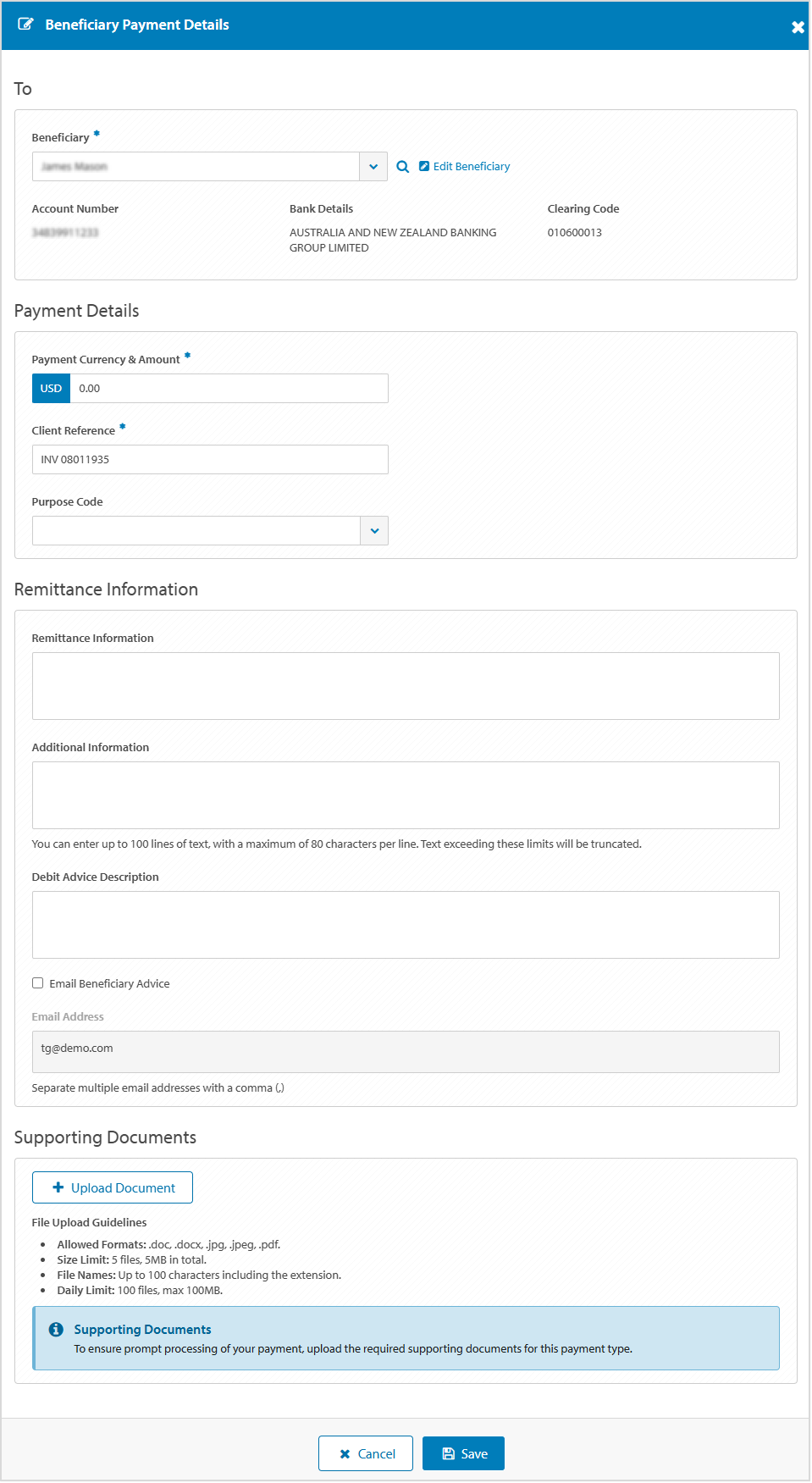

Beneficiary Payment Details screen

The following image is an example of a Beneficiary Payment Details screen with fields including the beneficiary's name, address and account details, beneficiary bank details, beneficiary email advice option, and additional remittance information.

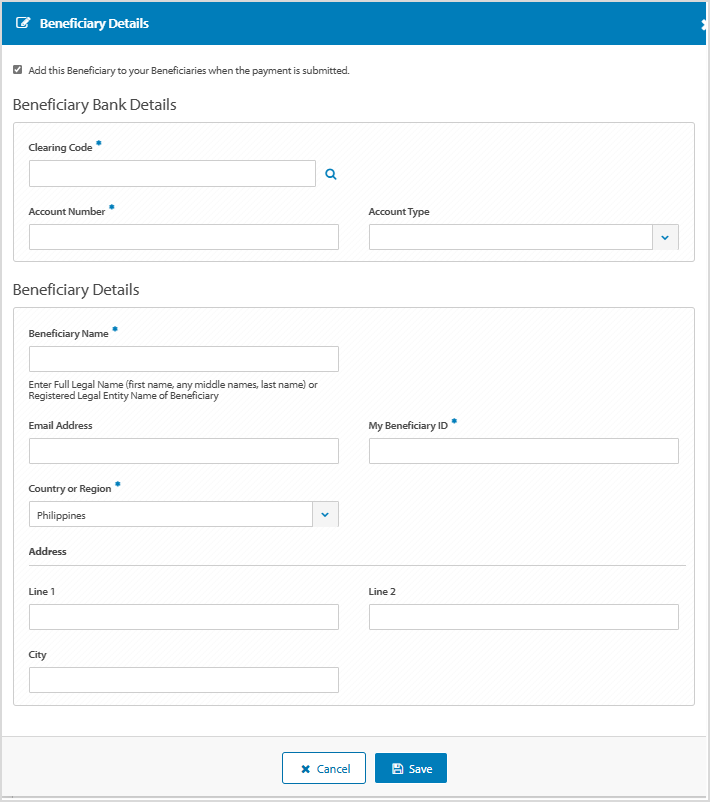

Beneficiary Details screen

The following image is an example of the Beneficiary Details screen with fields including the beneficiary bank details, beneficiary's name, address and account details, beneficiary bank details, and beneficiary email address.

Beneficiary Details grid - Masked salary payment

The following image is an example of the Beneficiary Details grid where fields within a salary payment are masked, including beneficiary name, account number, client reference and payment amount. These fields are represented by 'XXXX' and only visible to users with applicable entitlements.

Users without applicable entitlements will receive a pop-up message, "You are not entitled to view instruction details."

Users without applicable entitlements will receive a pop-up message, "You are not entitled to view instruction details."

Create a GSRT template

To create a domestic payment template, follow the steps below:

| STEP | ACTION | ||||||||||||||||||||||||||||||||||||||||

| 1 | Click Payments > Templates menu. | ||||||||||||||||||||||||||||||||||||||||

| 2 | Click New on the Control Bar. | ||||||||||||||||||||||||||||||||||||||||

| 3 | If required, choose a Country or Region where the funding account is domiciled. Select either:

|

||||||||||||||||||||||||||||||||||||||||

| 4 | Click Domestic Payment Template or Domestic Salary Payment Template. | ||||||||||||||||||||||||||||||||||||||||

| 5 | If required, select the Division the payment will be made from. If you are entitled to more than one division, you can set a default division for future payments. |

||||||||||||||||||||||||||||||||||||||||

| 6 | Select the Debit Account. | ||||||||||||||||||||||||||||||||||||||||

| 7 | Select GSRT Payment Method. | ||||||||||||||||||||||||||||||||||||||||

| 8 | Enter a Template Name up to 35 characters. This will become the Template Name when you create a payment from the template. | ||||||||||||||||||||||||||||||||||||||||

| 9 | Enter Template Description up to 40 characters. | ||||||||||||||||||||||||||||||||||||||||

| 10 | Enter a Payment Reference up to 35 characters that will appear within the narrative on the funding account, beneficiary's statement and payment reports. | ||||||||||||||||||||||||||||||||||||||||

| 11 | If required, enter a Debit Advice Description up to 55 characters that will appear on your debit account statement. | ||||||||||||||||||||||||||||||||||||||||

| 12 | If required, untick the Disable Beneficiary changes for Payments created from this Template indicator to allow beneficiaries to be added or edited. | ||||||||||||||||||||||||||||||||||||||||

| 13 |

To reduce the risk of fraud, ANZ recommends you always confirm beneficiary details when processing a payment.

Control Bar

Click Add to add one or more beneficiary details using the following options: Add Beneficiary from your Beneficiaries list

Search and select the Beneficiary from the Beneficiary Name field, then proceed to next steps. If required, click Add again to add additional beneficiaries.

Add New Beneficiary

Users must have entitlements to create new beneficiaries to complete these steps.

|

||||||||||||||||||||||||||||||||||||||||

| 14 | If required, enter Client Reference up to 35 characters if different from the Payment Reference prepopulated. | ||||||||||||||||||||||||||||||||||||||||

| 15 | If required, enter the Beneficiary payment amount. This can be added or updated at time of payment. |

||||||||||||||||||||||||||||||||||||||||

| 16 | If required, click Beneficiary Payment Details icon to view or update additional beneficiary information:

Add or update Beneficiary Payment Details

|

||||||||||||||||||||||||||||||||||||||||

| 17 | Do you wish to continue the payment at a later stage?

|

||||||||||||||||||||||||||||||||||||||||

| 18 | Click Review & Submit. | ||||||||||||||||||||||||||||||||||||||||

| 19 | Click Submit.

RESULT: Payment has been submitted and pending approval.

|

Errors and Alerts

Error and alert messages such as 'fields validations' display information about the impacted field(s) and highlights the field(s) in red. Error messages are specific to the payment method types, fields available and particulars validations. You can update the information within the impacted field(s) and continue processing the payment.

Mandatory field validations:

Beneficiary alert notifications:

- Error is indicated by a red triangle. Details must be corrected to proceed with payment processing.

- Alert with Warning is indicated by an amber triangle. Details can be corrected or accepted to proceed with payment processing.

Errors and Alerts within the Beneficiary Payment Details screen:

- Error is indicated by a red triangle. Details must be corrected to proceed with payment processing

- Alert with Warning is indicated by an amber triangle. Details can be corrected or accepted to proceed with payment processing

Next Steps

When the payment template has been successfully submitted for approval and is in a Pending Approval status, the next steps can be:

- Approve Payment Template or,

- Reject Payment Template back to the initiator for editing or deleting.

When the payment template has been successfully approved and is in an Approved status, the next steps can be:

- Create payment from template

- Manage payment templates to copy, delete, edit, recall or view.